Table Of Content

- Down Payment Assistance Programs And Grants: What They Are And How They Work

- The Pros And Cons Of Buying A House

- Complete Guide to Mortgages: What Type of Home Loan Is Best for You?

- Step 8: Submit your loan application

- First Time Home Buyer Mistakes And How To Avoid Them

- Buying and selling a home will change soon. Here’s what you need to know.

With a cash-out refinance, homeowners can borrow more than their original loan balance and receive the difference in cash. A mortgage is a financial agreement between a borrower and a lender, where the lender loans you money to buy a home based on an applied interest rate. As the borrower, you agree to repay the balance in monthly payments, which apply to both the principal loan balance and the accrued interest.

First-time buyer: Programs and assistance - CNN Underscored

First-time buyer: Programs and assistance.

Posted: Wed, 15 Nov 2023 15:24:35 GMT [source]

Down Payment Assistance Programs And Grants: What They Are And How They Work

Cooperation with your lender only makes the mortgage loan process easier, so be sure to provide any requested information as soon as possible. Interest rate and buyer requirements vary depending on the type of property you’re after. Keep in mind that not every lender finances every type of property (mobile, manufactured, commercial, etc.). Want to buy a small single-family home that you plan on using as your primary residence? You’ll probably get better terms because lenders know that primary housing costs already factor into most people’s budgets, and you’re more likely to stay up to date with your payments. Once you’ve reviewed your Closing Disclosure, it’s time to attend your closing meeting.

Conventional Loan Requirements for 2024 - NerdWallet

Conventional Loan Requirements for 2024.

Posted: Thu, 28 Mar 2024 07:00:00 GMT [source]

The Pros And Cons Of Buying A House

This offer does not apply to new purchase loans submitted to Rocket Mortgage through a mortgage broker. Rocket Mortgage reserves the right to cancel this offer at any time. Acceptance of this offer constitutes the acceptance of these terms and conditions, which are subject to change at the sole discretion of Rocket Mortgage.

Complete Guide to Mortgages: What Type of Home Loan Is Best for You?

First, you’ll have one last visit to the home before you officially own it. Aim to schedule your final walk-through shortly before the closing. Make sure that the home is in good condition, that the owner has removed all their belongings and that the property is free of issues. An FHA loan is a type of mortgage that's backed by the Federal Housing Administration. A home is the most expensive purchase most of us will make in our lives, and interest can add hundreds of thousands of dollars to that cost.

Contact the HFA in your state to find out what options are available. It’s also a good idea to work with an HUD-approved housing counselor. This individual can evaluate your situation and help you find programs that may be a good fit for you.

Step 8: Submit your loan application

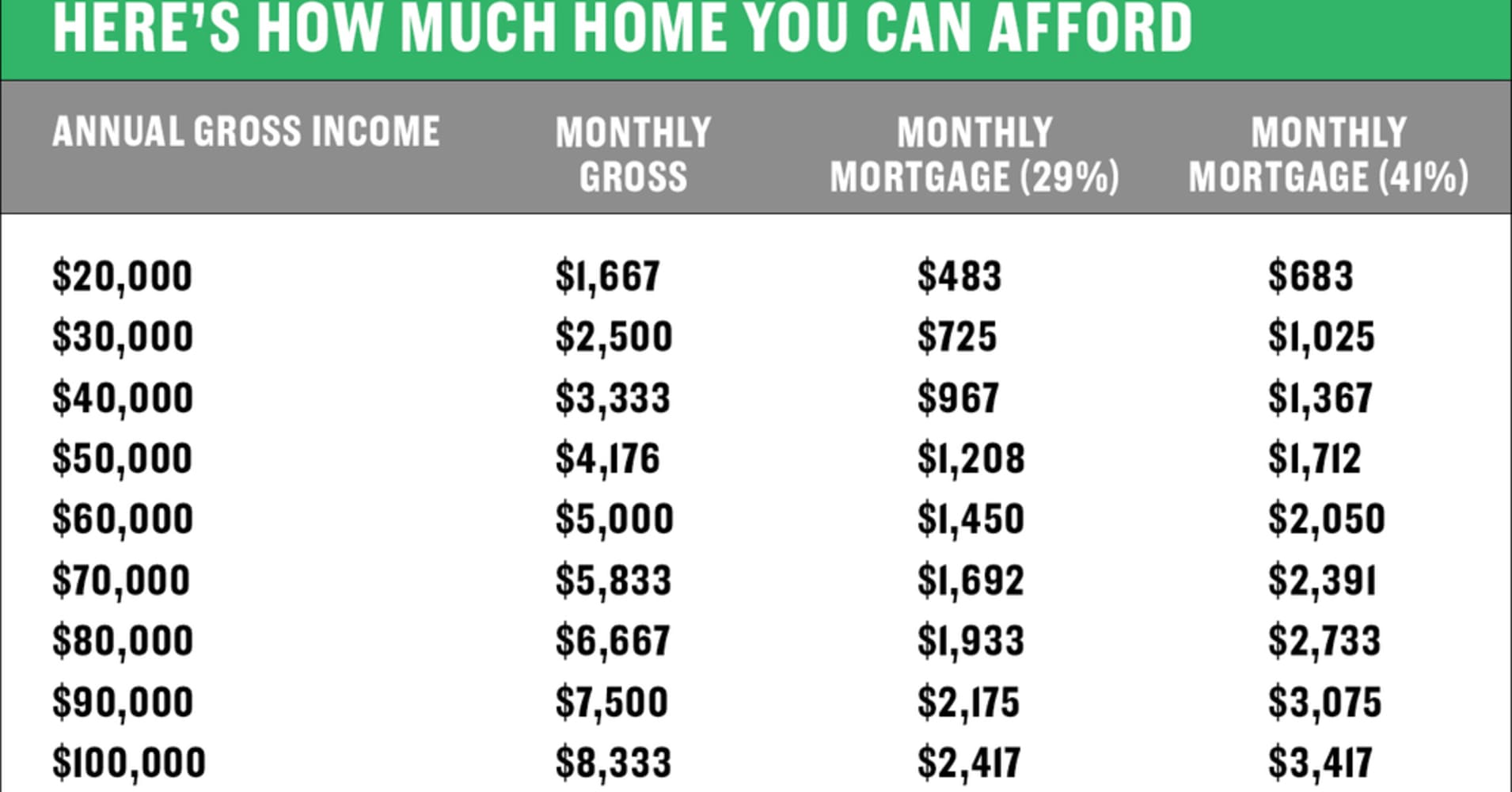

The bigger your down payment, the smaller your loan amount will be and the less you’ll pay to your mortgage lender each month. Your debt-to-income ratio (DTI) is another key consideration for a lender when deciding whether to approve you for a mortgage. Lenders use your DTI to determine if you can successfully take on additional debt – specifically, your monthly mortgage payment.

Income And Job History

The lower your DTI, the better chance you have at being offered a lower interest rate. That’s why it’s important to know your must-haves, nice-to-haves, and deal breakers before viewing homes. Understanding what you can and can’t compromise on will help you know when to jump on a listing and when to walk away. Leave renting behind and start building your own wealth through homeownership.

Before we get into the credit score you’ll need to qualify for a mortgage, you might be wondering how lenders determine your credit score. After all, your FICO® Score is reported by three different credit bureaus. Your down payment isn’t the only upfront cost when you buy a house. These cover the lender’s fees and charges for professional services, such as the title insurance and home appraisal.

Based on your preapproval letter, your real estate agent can help you find homes within your budget. To buy a house, you’ll need enough money to cover the down payment and closing costs. These add up to at least 5 to 8 percent of the home’s purchase price. For example, if you’re purchasing a $300,000 home, plan on budgeting a minimum of $15,000 to $24,000. However, you may need as much as 22 to 25 percent if you want to avoid private mortgage insurance on a conventional loan.

If you are currently unemployed or have changed jobs recently, it’s wise to know that this may create a hurdle when seeking a mortgage. You might want to delay your home-buying plans until you have a more consistent employment record, or search for a lender that is less rigid in terms of this qualification. Buyers have the right to cancel the agreement at any given time if a disclosure statement isn’t provided.

But that hearing is largely a formality, and Judge Bough’s action in U.S. District Court for the Western District of Missouri now paves the way for N.A.R. to begin implementing the sweeping rule changes required by the deal. The changes will likely go into full effect among brokerages across the country by Sept. 16. Once you put money down on your mortgage, it’s not easy to get it back.

No comments:

Post a Comment